Governing Dynamics

Asymmetries

What are Asymmetries?

Asymmetries are all around us. Sometimes they are positive, and other times they are negative. Right now, you might be wondering what asymmetries are and how they were able to surround you in two sentences. I’ll explain, and hopefully, you’ll finish this very short section with a better understanding of how you put asymmetries from surrounding you to being in your corner.

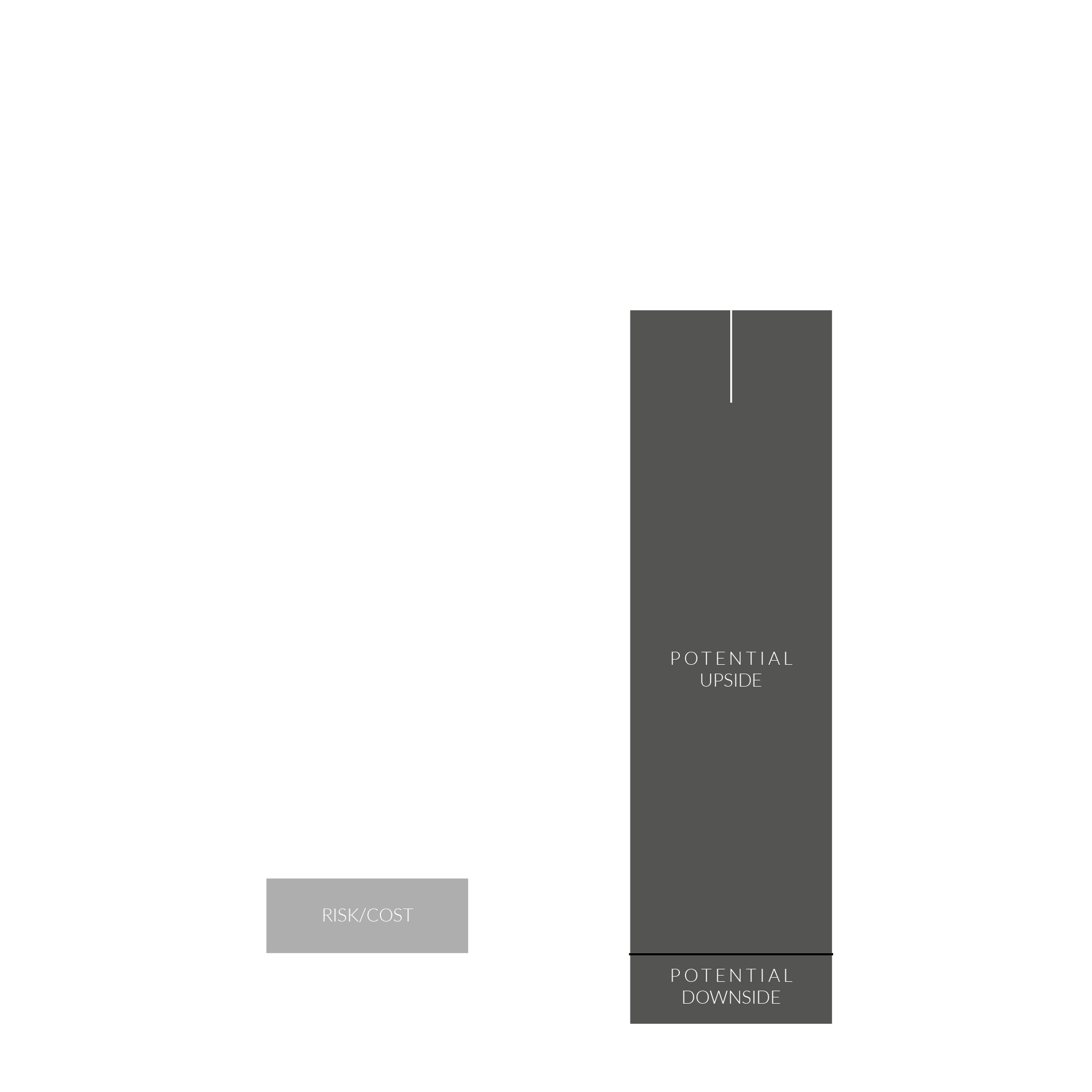

When we talk about asymmetries, I want you to think about what you are risking (time, money, opportunities, etc.) in relation to what you could potentially gain or lose in exchange (money, growth, valuation, etc.) and to understand the outsized proportions of payoffs/impacts/cost.

Positive Asymmetries are situations where what you are risking/paying is relatively low compared to what you will gain. Imagine investing $1 with a potential payoff of $1,000 or more. We’ll explore this more in-depth later with applications to startups, starting a new business, and other real-life scenarios.

Negative Asymmetries are situations where what you are risking/paying is relatively high compared to what you will gain. Imagine investing that same $1 with a potential payoff of $0.10 or $0.20. But imagine investing the same $1 and having the potential to lose $1,000. While you might be rolling your eyes right now, you’d be surprised how many people do this without thinking twice and being completely unaware. Keep in mind that the $1 can be completely lost in both situations; the Risk of loss is relatively the same.

The next concept we need to discuss is the idea of Bounding the asymmetrical options. Bounding applies to the potential payoff/gain.

A bounded asymmetrical opportunity is a situation where you have a limited or predetermined maximum gain.

An unbounded asymmetrical opportunity is a situation where you have unlimited potential gain.

The last concept is Risk Capping. Risk can be capped or uncapped (both within reason) and is essential when assessing opportunities and risk exposures. It also helps you select the suitable types of asymmetries you want surrounding you! The best way to think about capping risk is when you give your card to a bartender, and they ask you “open” (Uncapped Risk) or “closed” (Capped Risk.)

Capped Risk is where you have a hard limit on your automatic risk exposure. For example, in the $1 scenario, you are limited to losing the $1. You can choose to invest another $1, but it is entirely optional. That’s because you have a closed tab in the bar scenario from above. Your friend or a stranger can order more drinks, but you can reject or accept them being added to your bill.

Uncapped Risk is where you have open and automatic risk exposure. For example, in the $1 scenario, if you lose the full amount, you automatically invest another $1, even if you decide you don’t want to invest anymore. That’s because you have an open tab in the bar scenario, and drinks from friends or strangers can be added to your bill without your approval. In this case, the bartender is really unreliable. Very risky to drink there!

While some of these concepts may appear obvious in the abstract, they are surprisingly non-obvious in everyday applications in companies large, small, and those that just starting out. A solid majority of executives, investors, entrepreneurs, and seasoned operators consistently make Uncapped Unbounded Negative Asymmetrical investments and don’t realize it until it’s too late and the bartender gives them the bill. That’s what this section and Governing Dynamics is about—identifying, assessing, and avoiding negative asymmetries that are unbounded, uncapped, or both.

Now that we understand asymmetries better, let’s discuss how I can help you master them.

How I Believe it Applies.

Asymmetries are surrounding us and our businesses whether we like it or not. I believe it makes more sense to understand clearly what real opportunities are available to you in absolute terms and what massive risks are lying in wait to surprise you. Only then can you do anything about it.

Nietzsche wrote, “There are two different types of people in the world, those who want to know, and those who want to believe.” I don’t want to believe my opportunities, risks, and future prospects are secure; I want to know it through careful examination of my strategies, reasoning, base assumptions, and biases. Done systematically and objectively.

The most successful companies in history mastered the art of knowing. But the breeze of success can make those who once knew about these risks, forget. Asymmetries remind all of us that we will never know enough to believe without rigorous testing and examination of our plans.

Asymmetry Identification Matrix™

Why Should You Care.

Companies that systematically identify, design, and launch asymmetrical experiments into their primary and non-primary markets will be set to innovate into the future, benefit from uncertainty, and thrive with a statistical advantage over average firms.

The majority of companies are developing negative asymmetrical experiments and running negative asymmetrical risks but they are completely unaware of it. This is results in:

Existing companies have a significant opportunity to lower their risk, improve innovation, and uncover asymmetrical opportunities that can take the business and the team into the future.

Entrepreneurs have a massive opportunity to develop more competitive products, services, and companies by developing well-crafted asymmetrical experiments that help them identify valuable opportunities, markets, customers, and needs faster than larger companies or other startups.

Just as important as identifying new opportunities, teams that master identifying, assessing, and mitigating current or potential negative asymmetries will be able to navigate markets, disruptions, and uncertain events better than their competitors.

How Does it Tie Into Our Methods & Services?

Over the years we’ve developed methods, frameworks, and solutions to proactively identify Positive Assymetries to develop and simultaneously identify and mitigate Negative Asymmetries that were developing, suggested, or in our way.

Contact us today if you are ready to identify the asymmetries that are most relevant to your business and industry.